So, you want to buy a new car? Buying a new vehicle can be confusing and expensive. After the cost of a house or a divorce, it’s one of the most expensive purchases most people will make, so it’s important you take your time and consider what’s right for you when it comes to the best way to acquire a new vehicle.

In this article, I will discuss the pros and cons of each option so that you can make up your own mind about what’s right for you. I am not affiliated with any dealership network or financial institution, I’m not making any money out of this. I’m just a guy on the internet with a passion for cars and research.

Cash is king

The cheapest way to buy a car is to save up the money you want to spend in advance and just purchase the vehicle outright.

Unfortunately it’s also the least fun and requires proper adulting skills like patience and saving.

Buying safely

If you’re buying in a private sale, make sure you don’t transfer any money until you have the car in your possession. If buying used, and lets face it, few people buy new cars with cash, you will want to make sure the car is not an insurance write off so has outstanding finance first. Nobody wants to buy a lemon (sorry Keith).

If you can pay with credit card (then immediately pay the card balance), this gives you some extra protection on top of your statutory rights.

Negotiating when paying cash

One word of caution, when looking at cars in dealerships, do not tell them immediately that you want to pay in cash. Dealerships make most of their money from selling you finance deals and additional services like gap insurance. They’re not going to make as much money out of you if you’re paying in cold hard cash so it actually weakens your negotiation power.

Right now we are in a sellers market. There is so much demand for vehicles and limited production that used cars are selling sometimes for more than the list price of new cars. Dealers have little incentive to offer you discounts, regardless of whether you’re buying new or used vehicles so the best strategy is to bide your time, negotiate the price as best you can, then tell the dealer that you would like to pay in one lump sum instead of taking up that high interest finance deal.

Personal Loans

If you don’t have the money, you could take always take out a personal loan over a time period to suit you.

As you will be paying for the car in full, the car immediately belongs to you and this is often cheaper than taking out car finance through a dealership but the same negotiation rules apply as I mentioned for cash.

Cheapest finance option

I would recommend this option if cash isn’t an option. However, it’s worth remembering that you’re still responsible for the payments even if you sell the car or it is written off.

You can take out a loan for any period from 1 to 7 years, the better your credit rating, the more likely you will be accepted and the better the interest rate you will be offered. It is always best to use credit reference services to check your credit score. Many such services are free and offer deals that are soft checked against your file to give you a better idea of whether you will be accepted before you apply.

Check your credit score

I use the Credit Karma App, the Clear Score App and Experian’s free monthly service (not the expensive Credit Expert offering) and Money Supermarket. There are three main credit reference agencies in the UK, Trans Union, Equifax and Experian and it’s not unusual for them to have different data about you and different scoring mechanisms so check them all, regularly. If you have more money than sense and want to pay to see all credit reference agency scores at the same time then CheckMyFile.com offer a £14.99 per month service.

As you are paying for the full cost of the vehicle, often the monthly repayments are higher than some other forms of credit but you can purchase without having to pay a lump sum deposit and the interest rate will normally be lower than what a dealer will offer you. Interest rates are going to be rising over the next few years and car prices are going to be going up too so don’t wait for prices to fall, act now.

Hire Purchase (HP)

Hire Purchase used to be one of the most popular ways to purchase a vehicle but it’s popularity has decreased as it’s generally one of the most expensive ways to purchase a vehicle.

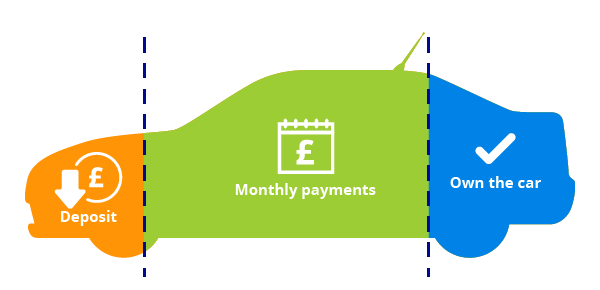

With HP, you pay a deposit towards the vehicle or trade in your old car, you pay a fixed monthly payment over a period, typically five years and then at the end of that period, and after paying a “registration fee”, the vehicle then becomes yours to do with as you will.

You cannot sell the car until you have paid off the finance. The interest rate is typically higher than a personal loan but it may be an option if you have a bad credit rating as dealerships are normally less fussy than banks about lending money. There is no mileage allowance and no penalties for damage, although that will affect the selling price after you have finished paying for the vehicle. Deposits can be quite sizable too.

I wouldn’t recommend this option unless the alternative options are not available to you.

Personal Contract Purchase (PCP)

PCP is a little bit more complicated than the other options.

Firstly you pay a deposit, then you pay a regular fixed amount over a period of your choice, typically 24 to 60 months (2-5 years). At the end of the agreement, you have the option to buy the vehicle by paying a balloon payment, or you can return the vehicle or exchange it for another vehicle.

The dealer will also give you a minimum future value figure that they believe the car will still be worth by the end of the agreement. If you buy the vehicle and the car is worth less than that minimum (based on their evaluation), they will refund the difference or put that money towards your next PCP deposit for a new car.

Lower monthly payments compared to HP or Personal Loan

Because you’re not paying the full value of the car, the monthly repayments are typically lower. You will agree to a mileage rate per year and if you have done more than the total miles agreed over the period, you will be charged an excess per mile if you return the vehicle but most people will trade in the vehicle for another shiny new car.

If you know that you will definitely want to keep the vehicle at the end of the period, PCP is the most expensive way to buy the car but if a lower monthly payment and flexibility is more important to you, PCP can be useful. You will sometimes be able to trade your vehicle in with your dealer early.

Dealers love you…

Dealers like PCP because most customers will come back and trade in their car to purchase another vehicle but it does mean you are at the mercy of their evaluations of the current value of your car unless you are willing to pay the balloon payment. The vehicle only belongs to you after paying the balloon payment.

PCP is normally only provided by dealers, so it’s harder to shop around, however you can use services like Car Wow that will pit dealers against each other to offer their best price PCP deal.

Usually, the dealer will buy back the vehicle for a figure that is greater than the balloon payment, so you will have equity that can be used as the deposit for your next PCP deal so you shouldn’t have to pay as big a deposit next time or you can still pay a deposit and the monthly payments could be lower.

Flexibility

PCP is flexible. Don’t have a big deposit? That’s ok, but the monthly payment will go up. Have a fixed monthly figure? You can increase the deposit or the dealer may make the balloon figure higher, however, the dealer needs to make sure that the balloon payment will likely be less than what they will be prepared to buy the vehicle back for at the end of the period.

It is possible for you to end up with negative equity at the end of the vehicle if the vehicle is worth less than the balloon payment so make sure you look at the difference between the balloon payment and guaranteed minimum future value and reject the deal if that minimum value is less than the balloon payment. Balloon payments are normally a significant sum of money and if you cannot afford to pay it but feel the dealer is offering you an unfair trade in price then your only option is to accept the offer or lose the vehicle for nothing.

The current state of things – everything is on fire!!!

PCP does give you an edge in the current market as residual values are high for many vehicles and there is a shortage of semiconductor supplies that modern cars rely on so it is unlikely the demand side push on prices is going to change over the medium term.

The lack of production during the COVID period, coupled with increased demand means dealers need more used cars to sell on their forecourts but there are a lack of cars coming through at the end of PCP or PCH deals meaning some dealers are offering customers the opportunity to trade their vehicles in for newer models earlier than under normal market conditions. Manufacturer discounts are disappearing but there is still some negotiating to be achieved with dealers that need cars to sell. Manufacturers are no longer allowing dealerships to buy vehicles themselves in order to meet sales bonus targets due to the general shortage so there are no pre-registered deals available, whereby new cars are discounted because you will be the second owner, not the first owner of the vehicle.

Personal Contract Hire (PCH)

With PCH you rent a new vehicle over a period between 1-4 years. When the vehicle is delivered, you pay an initial payment that is either, 3, 6, 9 or 12 times the agreed monthly payment before regular monthly payments for the duration of the term.

Like with PCP, you agree a set rate of mileage per year and if you have driven more miles when the vehicle is returned, you are charged an excess per mile. The vehicle is never yours. Some lenders will give you an option to buy the car at the end of the period but you will not know the price until the last three months of the deal and you have no guaranteed right to buy the vehicle. You must return the car in the same condition it was provided, with concessions for fair wear and tear but you may be charged for any excess damage. An assessor will inspect the vehicle with you when they pick it up.

Lowest monthly payments (typically)

The advantage of PCH is that the monthly payments are often cheaper than any other financial package. You can choose between including a maintenance package or not. Road tax is included but it’s your responsibility to service and MOT the vehicle per the manufacturers guidelines, unless you have a maintenance plan that includes this cost.

Some people don’t like leasing because you’re putting money into paying for the car but you never own it. This also means you’re not responsible for selling it and you may be able to afford a better car than you could with other finance options.

Shop around

There are a lot of leasing brokers online, and they’re very competitive. Typically they charge a fee around £300 for brokering the deal and this is paid up front but you do not pay the initial payment until the vehicle is delivered.

Mind the gap (insurance)

With all finance deals your need to remember that should the vehicle be stolen or written off, for any reason, you will still be liable to make the payments even though you have no car. If you have fully comprehensive insurance, which is an absolute must, then in the event of loss of vehicle the insurance company will pay out the current market value for the vehicle, which could be thousands of pounds less than the outstanding finance owed and you will be liable for that difference.

For this reason, it is essential that you get gap insurance to cover the gap between insurance payout and finance owed, plus your insurance excess and the cost of your next initial payment or deposit. Dealers will often offer this product to you but you will often find a better deal online. Make sure you check exactly what is covered, not all gap insurance policies are equal.

Check the cover length as well as the maximum pay out. When I took my last finance deal in 2019, I paid £214 for four years gap insurance with www.directgap.co.uk. The cover included up to £2000 deposit contribution should my vehicle be written off as well as unlimited gap protection.

What I do

This is how I obtain new cars. You do need to remember that you will need to save up for the next initial payment and also make sure that you can cover any damage penalties. PCH isn’t as flexible as PCP. If you wish to terminate early, you will be charge 50% of the remaining monthly payments.

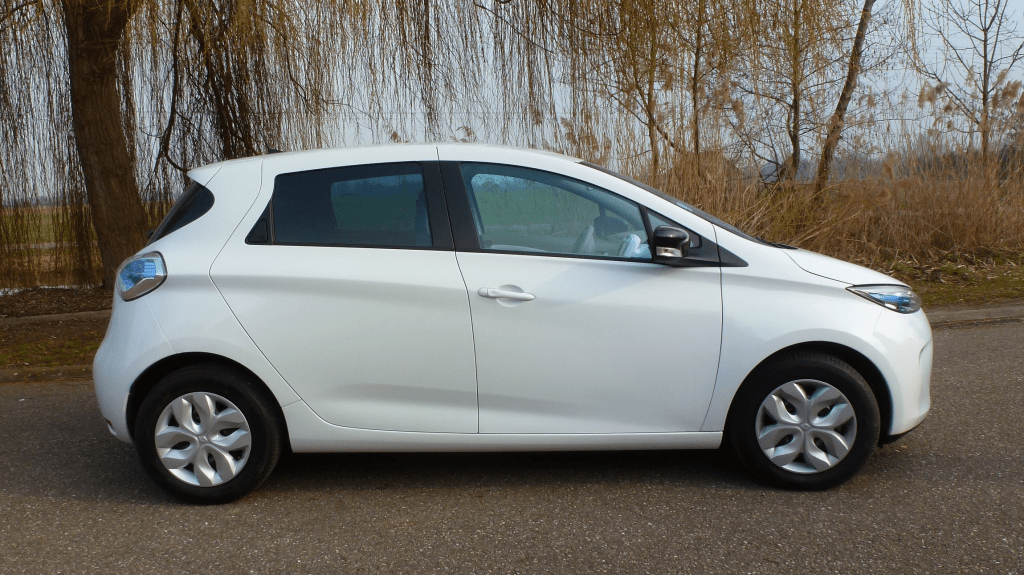

A real world PCP versus PCH comparison

Just to give you a sense of comparison, I asked a local dealership for a PCP quote for an MG ZS EV Trophy Connect trim in Battersea Blue (the top trim) through their affinity discount scheme. The list price of the vehicle is £32,540.00 and I asked for a 4 year deal with a £3200 deposit and mileage allowance of 8000 miles per year. The dealer price was £412.08 per month.

Online I was able to find the same vehicle on a 9 month initial payment (£2,698.92), 4 year deal with the same 8000 mileage allowance for the price of £299.88 per month, making the total cost including a £360.00 admin fee £17,453.16 compared with £22,979.84 for the PCP offer. That’s a saving of £5,526.68 over the length of the deal.

The difference in cost over that period, would be enough to pay the same initial payment on the vehicle twice over, but I would have no equity to use towards the next deal. The balloon payment would have been £12,456.00.

Be flexible, friend

Lease prices change very quickly. The best way to get a great deal is to be flexible in terms of colours and not expect any excess. Fleets buy large number of vehicles in order to get big discounts with manufacturers but as the vehicles are often from stock rather than factory orders, numbers are limited. Always shop around and compare prices. Beware extremely low mileage deals as if your go over the agreed mileage the additional charge can soon add up.

The deal I mentioned with the MG ZS on PCH is no longer available and the new price at the time of writing is £424.08, which makes it more expensive than the PCP deal. This is why shopping around is so important. Get as many quotes as you can, you’re not duty bound to accept any of them.

Timing is everything

I happen to know that a new version of the ZS EV is due to start production in October so the price I found was likely to be an attempt to make way for the new model. Sometimes when you buy is important. Car registration plates change in March and September so late February and August used to be a good time to aim for before the supply issue forced prices up.

Anytime a new model is due to be released, the older versions are normally discounted so search owners forums and press releases for this kind of information. Knowledge is power. Dealers hate it when a customer comes in with all the information already at hand. Believe it or not, sometimes dealers are the last to know about these things.

Appreciating depreciation

According to https://www.omnicalculator.com/finance/car-depreciation, assuming average depreciation in value, the vehicle would be worth £15,912.06 after four years, leaving equity of £3,456.06 towards the next vehicle so in this case, it looks like the lease would still be the cheaper option but that won’t always be the case and it is likely that a used EV under current market conditions will fare much better than average depreciation.

That is the fun with PCP, you need to be a fortune teller to guess what that buy back price will be and because you cannot sell the car unless you pay the balloon payment, you’re at the mercy of the dealership when it comes to buy back price. The better condition you keep the car in, the higher that future price will be so although in practice there are no damage penalties, in reality making good any damage will be factored into the price.

I am not loyal to any one brand of vehicle or dealership, I like to try different cars so for me, leasing keeps all my options open without having to obtain some sort of bridging loan to pay the balloon payment and then having the hassle of selling the vehicle privately but that’s just me. Your circumstances may be different. The most important thing to take from this is to do your own research. Don’t allow the dealer to confuse you with numbers. Don’t rush into an agreement immediately after viewing a car and falling in love.

Thanks for reading

I hope you have found this guide useful and informative. All information

In my next article, I will explain how I approach the whole process of obtaining my next car but I hope you have found this piece informative and useful.